Shortcut to Business Success

Entrepreneurship Through Acquisition can immediately get you your own profitable business to run.

In my previous post, I walked through the opportunities I was evaluating in order to jump off the corporate ladder with the goal of taking my future into my own hands.

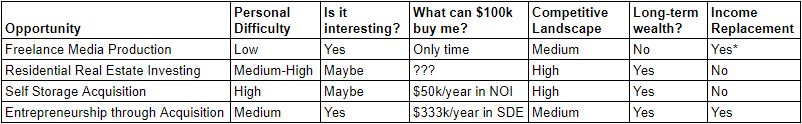

Here is a recap of the evaluations according to my personal rubric:

Entrepreneurship Through Acquisition stands out as my best option.

So, what exactly is “ETA”? The University of Pennsylvania Venture Lab sums it up as “buying and growing an existing small business that has already demonstrated product-market fit.”

OK, that seems simple enough. I’ll buy a business that is already successful and has ongoing operations with the goal of growing it.

To do this, I’ll take on a large loan in order to purchase the business and be living under the weight of that large debt until it is paid off.

“Wait - I thought debt was bad; wouldn’t it be better if I start a company and bootstrap it into the next Facebook?”

Go for it! However, most people know that very few startups actually survive and thrive, and the odds that your new company will be the next Facebook or Google are incredibly slim. Personally, I’d be content with a successful business that no one has ever heard of (as long as it provides a good product to its customers and a good quality of life to its employees and owner).

Let’s get back to the debt. Yes, personal debt is generally bad because that tends to be debt against depreciating assets (boat, car, Gucci purse, etc.); however, business debt is the lifeblood of the economy. When the Federal Reserve raises interest rates, their goal is to “slow down” the economy. This basically means that they will slow the amount of debt capital available for businesses to grow by making it more expensive.

Let’s look at a simple equation then:

Net Income - Debt Service = Net Profit

If Net Income ≥ Debt Service, you are winning!

OK, so debt might be OK, but how do I even get started.

Self-evaluation: What most resources and experienced ETA people will tell you is to start by taking an inventory of your personal skills. This will help you to find a business opportunity where you can add value simply by being part of the team.

Personal financial statement: If you are going to take on debt to acquire a business, you need to get a full view of your personal balance sheet. How much cash (or cash equivalents) do you have on hand? Do you have a lot of outstanding debt? What is your net worth?

Target statement: Some experts will have a different name for this, but after you have figured out what you’re good at and how much money you have to deploy, figure out what type of business you want to purchase. Is there a specific industry? Is there a geographical requirement? Do you have a revenue or earnings requirement?

Go find it: It might be tempting to simply go onto bizbuysell.com and start into it. Many experts will discourage you from this. The thinking is that only the “garbage” ends up on bizbuysell; most business brokers have relationships with and lists of people they have actually met and know can close a deal. It makes sense and it reinforces that relationships and networking are key. Most brokers will sell their best listings before it even hits a big listing site like bizbuysell. That means, you need to pick up the phone and call business brokers in your target geography or industry to introduce yourself, make sure you tell them what you’re looking for, that you have the money (getting pre-qual’d at a bank can actually provide you a proof of funds), and are serious about closing. I did this and forged some relationships, it was not hard. That being said, I found occasionally browsing bizbuysell somewhat eyeopening. You may not find the best opportunity posted publicly on bizbuysell, but browsing the listings and contacting brokers accomplished two things: 1. I actually later followed up with some of the brokers and forged relationships and 2. It gives you a great view into the economics of small businesses and can actually open your eyes to previously unknown (to you) opportunities that might be a good fit for you.

I won’t go more into why or how ETA can be a great path into business ownership or how to do it, but I’ll link to some resources that I used below.

Read more about ETA’s advantages:

Buy Then Build by Walker Deibel, great book

”Harvard Business Review: Buying Your Way into Entrepreneurship,” very solid article,

HBR Guide to Buying a Small Business this expands upon the article above

Business Wealth without Risk by Roland Frasier, a bit sensationalized, but some good info and ideas

For “non-traditional” businesses (mainly digital in nature), these are some good brokerage sites to tap into:

If anyone has any tips or other resources to share, feel free to post them in the comments below.

Nice article, thanks for sharing.

Looks like your link for quietlight points to acquire instead.

Great Post! I'm in largely the same situation (just left my corporate job a few months ago for entrepreneurship, I'm about 50/50 between building/buying something currently). Haven't quite found a listing that calls out to me.

Really looking forward to your next posts on how the acquisition is going. Presumably from https://mtlynch.io/i-sold-tinypilot/ you were the purchaser? Funnily enough, I saw that listing on quietlife as well!