How to Jump Off the Corporate Ladder

I know what I want and when I want it, but how do I do this (gracefully)?

I’ll start this post by restating the main thrust of the why:

My goal is not just to depart a specific corporation that controls my quality of life and financial future, but to ensure that I have that control in my hands. (If you missed the context for the why, the what, and the when, make sure you check out my preceding post.)

Working in Media Production (as I do), a large portion of the workforce works on a contract basis as a freelancer. This is an obvious route I could take to jump off the ladder and “be my own boss.”

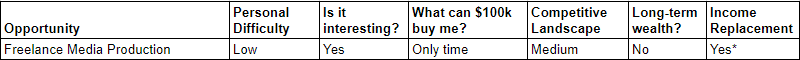

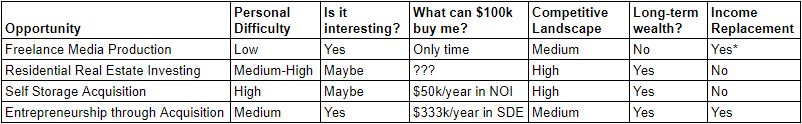

But before jumping at the most obvious solution, I wanted to create a rubric to help me evaluate opportunities and how they might help me reach my goals.

The Rubric

Level of Personal Difficulty

Early on, I knew I had to try to evaluate what unique skills and experiences I had that would help me in my next…whatever is next. So, I did that. I took some time to comb back through my life and résumé to see what I’ve been able to do well and what skills I now have. This grade tries to evaluate how hard an opportunity would be for me to execute, when taking into account my skills, strengths, and experiences.

Is it interesting?

This is kind of self explanatory. Ralph Waldo Emerson said, “Nothing great was ever achieved without enthusiasm.”

What can $100k buy me?

No, I’m not trying to see if I can afford a maxed out Rivian R1S. I have around $100k that I am able to deploy in some manner to help me into what’s next; so what does that $100k buy me towards my cash flow goals?

Competitive Landscape

This is a stab at reading how hard it will be to succeed in a certain opportunity when taking into account various market dynamics.

Does this grow into long-term wealth?

I don’t want to have to work forever, I want to build a nest egg (ahem, quickly) that can sustain my family and our quality of life well into the future. Does this opportunity appreciate in value or simply provide cash flow?

Does this immediately replace my income?

This is kind of the linchpin. I’m ready to leap off the ladder, but if I don’t have a similar income ready to go, that is an issue.

OK, so now that I have my rubric, how does Freelance Media Production look?

Level of Personal Difficulty

Media Production is what I have done for 20 years, this would not be too difficult.

Is it interesting?

I love the adrenaline rush of Live Media Production and still find it interesting.

What can $100k buy me?

$100k can’t really buy me any level of cash flow with this opportunity, just runway to build a clientele.

Competitive Landscape

The landscape has definitely become more competitive and the use of AI will be a gamechanger, but I have specialized, in-demand skills and beaucoup experience.

Does this grow into long-term wealth?

No.

Does this immediately replace my income?

Yes*, after a period of time to build up my book, this would replace my income. I estimate it would take about 10-12 months.

OK. Freelance Media Production checks some boxes but, I’m not sure jumping off the ladder into this is worth it.

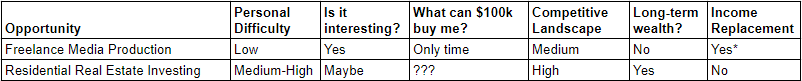

Residential Real Estate Investing

I have a small amount of experience and plenty of connections in Residential Real Estate Investing. This is obviously a broad category; anything from wholesaling house deals, fixing and flipping, or buying and holding rentals kind of fits in here. What does the rubric say?

Level of Personal Difficulty

I think this would be somewhat difficult for me; I’m not a seasoned “dealmaker.”

Is it interesting?

Maybe. Too hard to tell.

What can $100k buy me?

It depends, am I fixing and flipping, buying and holding, using leverage (obviously, yes)? I don’t think $100k helps me check the final box (see below), and that is potentially the most important.

Competitive Landscape

I think everybody and their brother, cousin, and dog “does” (or has done) Residential Real Estate Investing at some level. The interest rate environment makes a lot of this a bit more difficult (and I’m sure many have dropped out of the market due to that).

Does this grow into long-term wealth?

Yes, this is an excellent way to grow long-term wealth. Even dumb people can do it:

Does this immediately replace my income?

Maybe. Again, there are too many unknowns at this point and I’m not sure now is the best time to enter this market.

OK. Residential Real Estate Investing checks a few more boxes, but it is still no shoe-in.

Self Storage Acquisition

Self Storage is a sub-asset class of Commercial Real Estate. It has been on my radar as an investment for many years. The economics of Self Storage are simple: you own a piece of real estate for cost X, then you rent out many slices of that real estate for a fraction of X. The beauty is you are only providing minimal infrastructure (as compared to Multifamily), you really just provide a steel box on concrete.

OK, it is technically an operating business so it is a bit more complex than that makes it out to be. But nonetheless, it does have a few factors that make it very attractive:

Stickiness - People hate moving their stuff; per industry expert, Scott Meyers, the average stay in a storage unit is 2.5 years.

Valuation - Commercial Real Estate uses a cap rate to value property (not solely comps) and this can really help you juice appreciation of the asset.

Simple business model

No toilets, tenants, or trash

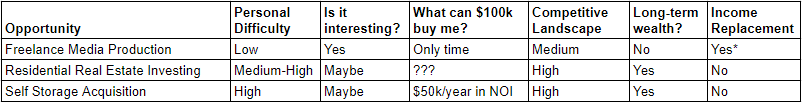

Self Storage has a lot going for it, let’s see how it rates:

Level of Personal Difficulty

Again, I think this would be somewhat difficult for me; I’m not a seasoned “dealmaker.” Additionally, I’m even less familiar with the world of CRE than I am with Residential Real Estate.

Is it interesting?

Maybe. The business is dead simple and can be formulaic, which I actually don’t mind.

What can $100k buy me?

You can get an SBA loan to purchase Self Storage at a 90% LTV. That means my $100k can purchase me a $1M Self Storage property. If we assume a cap rate of 5%, that means our NOI is $50k (before debt servicing). That is simplistic, but it definitely shows the difficulty of getting enough cash flow for the final box (see below) in the rubric.

Competitive Landscape

Self Storage has been a super hot asset class over the past decade. It is still a very fragmented market with a lot of “mom and pop” operators serving as acquisition targets. This has brought a lot more money to the market and increased competition for acquirers (or would be acquirers). Additionally, market dynamics have caused a bit of turbulence of late. Interest rates are high and storage rates are down, this makes any levered acquisition very hard to cash flow.

Does this grow into long-term wealth?

Absolutely, this is one thing that originally attracted me to this opportunity. There is a big chance that a person could do “one and done” - meaning “flipping” one Self Storage property could net over $1M in profit and leave you “set for life” (I guess this really depends on your spending patterns).

Does this immediately replace my income?

The difficulty of acquiring a property that cash flows at all right now (let alone enough for income replacement) makes this doubtful.

Entrepreneurship Through Acquisition

What is Entrepreneurship Through Acquisition? This is buying a successful, operating business and continuing to run and grow its existing operations. Harvard Business Review has a good article that provides more detail.

Let’s see how this stacks up:

*Note: a lot of the answers below are highly dependent on what type of business you plan to acquire - target wisely.

Level of Personal Difficulty

I’ve worked on technical projects, managed teams, and worked with vendors and high-level stakeholders. This would be somewhat hard for me, but I have well-rounded experience.

Is it interesting?

Running any sort of business will bring all sorts of surprises, it would be interesting in the sense that it keeps me on my toes.

What can $100k buy me?

You can get an SBA 7(a) loan at 90% LTV for acquiring a small business. That means my $100k can purchase me a $1M operating business. Now, valuation of operating business is much more opaque, but a common multiple to start with would be 3x SDE/EBITDA (that is basically how much profit a business generates before debt service). If we assume 3x SDE/EBITDA at a $1M valuation, that gets us $333k in profit (before debt service) on an annual basis.

Competitive Landscape

This is highly dependent on what sector the business operates in, but there is a wealth of acquisition targets currently as many business owners (baby boomers) are retiring.

Does this grow into long-term wealth?

Yes, although the 3x multiple does not grow your value as quickly as a CRE cap rate, you can still grow a business that you could later sell at a higher valuation (creating long-term wealth).

Does this immediately replace my income?

Yes! (finally)

OK! Only one of the opportunities on my list checks all the boxes - Entrepreneurship Through Acquisition. But, what exactly does that mean? How do I acquire a business? What types of businesses should I look at buying? Where can I find one? How does the process work?

I understand that I simplified a lot of items in this post for brevity’s sake. I’m simply documenting my journey and thought process - this is not meant to be an exhaustive guide. Thank you for understanding!